Five Ways to Go Green with Your Accounting

With St. Patrick’s Day and spring arriving, March is a great month to have “green” on the mind. There are green shamrocks, green beer, the green of new vegetation, and

With St. Patrick’s Day and spring arriving, March is a great month to have “green” on the mind. There are green shamrocks, green beer, the green of new vegetation, and

Many small business owners focus on generating more revenue every year, and that’s a great objective. But not all revenue is created equally. If you sell more than one product or service in your business, then you can benefit from looking at your revenue mix.

Although it’s fun to watch our revenues grow, it’s the profit number that really matters. If your expenses grow faster than your profits, then you have a lot of activity going on, but you don’t get to keep as much of what you make, which is what really matters.

With the holiday season just around the corner, it’s a perfect time to get your financial records in order. Tax moves you make now can mean finding more “green” to spend on family gifts and festivities. Today our team at Bryant & Associates share five quick tips for you to feel more prepared about your financial status as you go into year-end.

Watching the cash balance is one of the most frequent activities of a small business owner. Besides making sure you have enough cash for payroll and bills, there is another huge opportunity you can benefit from: lowering the cost of processing your bills. It can be expensive and time-consuming to process bills and handle the paperwork involved. We’ll take a look at a couple of the many ways you can streamline your accounts payable processing costs in this article.

At Bryant & Associates, P.C., our firm of accounting specialists knows that as time passes, so do tax breaks. Of those breaks that you may have come to rely on,

As a business owner, it’s important to understand how the Affordable Care Act may affect your business. If your company is covered by the Fair Labor Standards Act, you must provide a written notice to your employees about the Health Insurance Marketplace by October 1, 2013.

The Internal Revenue Service will be closed May 24, June 14, July 5, July 22 and Aug. 30, 2013. This is due to the current budget situation, including the sequester,

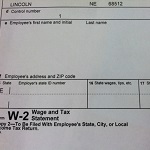

Did you get your W-2? These documents are essential to filling out most individual tax returns. You should receive a Form W-2, Wage and Tax Statement, from each of your

The end of the year is quickly approaching, there is still time for you to take steps that can lower your 2012 taxes. However, you usually need to take action